How to Buy a Used Car Without Getting Ripped Off

Your step‑by‑step guide to smart, affordable used‑car buying in America

New vehicles have become much more expensive in recent years as inflation and tariffs have hit car dealerships. A simple way to dodge the sticker shock is to opt for a used car, avoiding the immediate depreciation when you drive the car off the lot.

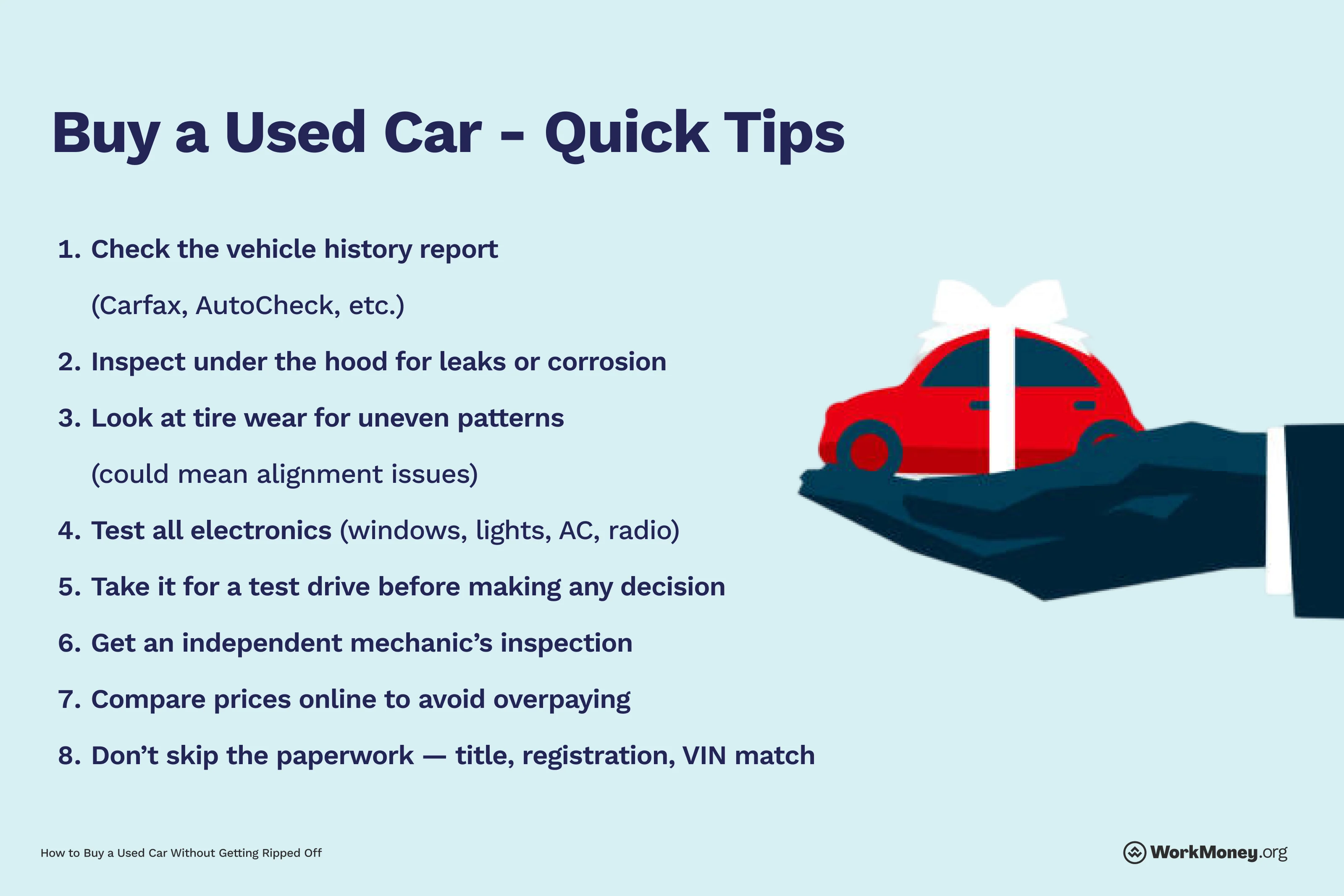

However, buying a used vehicle comes with a bit more due diligence to ensure you get a great vehicle that will last you for years.

WorkMoney put together a comprehensive guide on how to buy a used car without getting ripped off.

The Advantages of Buying Used

The advantage of saving money when opting for a used vehicle over a new one is clear. However, there are a few others that can continue to save you money and help you enjoy your vehicle.

Plan Before You Shop

Like any large purchase, it’s vital to have a plan in place. So before you visit the dealership, here’s what you can do to prepare beforehand.

Use a car budgeting rule

There are several ways to consider paying for a vehicle to determine if it’s affordable for you and your budget. First is the 20/3/8 rule. Here’s how it works: 20% down on the car, you should pay off the car in 3 years or less, and your car payment shouldn’t exceed more than 8% of your income. There’s also the 20/4/10 rule.

Whichever rule you pick, stick to it to ensure you buy a car that is affordable for you and your family.

Get prequalified

There’s a new incentive for car dealerships: they are banks that just happen to sell cars. This is because lenders partner with dealerships to offer loans to their customers. If the loan closes, the dealership gets a payout. That isn’t necessarily a bad thing, but the loans offered by the dealership may not be the most competitive.

It’s a great idea to research what kind of loans are available for new and used car loans, including how much you can expect to spend each month. And you can go to a dealership prepared with your own financing and negotiate the price of the vehicle to get the best deal.

If you aren’t satisfied with the loan options given, you can always consider refinancing your auto loan later. Caribou helps borrowers find better loan terms for their car loans.

Pick Where to Buy

There are two options for purchasing a used vehicle: buying from a dealership or a private seller.

Buying a used car from a dealership often comes with peace of mind, but that typically comes with a price hike. Dealerships typically inspect and recondition their vehicles, and many offer warranties that provide added protection on used vehicles. However, those protections come at a cost—dealers usually charge more than a private seller for the same car. You may also encounter extra fees that can push the final price higher than expected.

Buying from a private party can save you money, since there’s no dealership overhead or profit margin baked into the price. You might also have more room to negotiate, especially if the seller needs to move the car quickly. That said, buying privately is a more “buyer beware” situation. Be sure to run the VIN number through Carfax to get a detailed history of the vehicle. Additionally, if you find the perfect car, it would be wise to have a mechanic inspect the vehicle before agreeing to the purchase.

Make the Deal

Whether you buy a vehicle from a private party or a dealership, always try to negotiate the price of the car.

The best thing you can do is arm yourself with documentation of similar vehicles with similar mileage, along with the Kelley Blue Book value of the vehicle, to get the best price possible.

If the dealership or seller isn’t willing to budge on the price, it’s okay to walk away. The right car and seller will come.

Final Thoughts

A vehicle is a large purchase, and it’s important to take your time and do your research. You don’t want to end up regretting your purchase, especially something that only goes down in value.

About the Author

Brett Holzhauer

Brett Holzhauer is a Certified Personal Finance Counselor (CPFC) who has reported for outlets like CNBC Select, Forbes Advisor, LendingTree, UpgradedPoints, MoneyGeek and more throughout his career. He is an alum of the Walter Cronkite School of Journalism at Arizona State. When he is not reporting, Brett is likely watching college football or traveling.