What Credit Score Do You Really Need for a Car Loan in 2025?

Unlock better auto loan rates by understanding your credit score requirements

Paying for a new car can be a tricky process to navigate, regardless of your credit score. But the better your credit score is, the easier it may be to get the car you want, and the cheaper your loan will be.

Your credit score could save you thousands in interest over the life of the loan. But just because your credit score needs some improvement, doesn’t mean you should avoid buying a vehicle altogether.

The WorkMoney team analyzed current car loan data to see how you can leverage your credit score (good or bad) to get the vehicle you want and keep more money in your pocket.

What’s Considered “Good Enough” in 2025

It’s generally considered that if your credit score is above 670, you may be able to get qualified for an auto loan. If your score is below that, it doesn’t mean you're automatically disqualified. You may need to work with the lender (i.e. bank, credit union) to bolster your credit application. You may need to make a larger down payment or potentially have a co-signer on the loan to give the bank sufficient confidence that it will be repaid.

Additionally, if you’re approved for an auto loan at a higher interest rate doesn’t mean you’re stuck with those terms forever. You can always refinance your auto loan after you improve your credit score.

Caribou helps consumers find better auto loan interest rates to reduce how much they pay in overall interest.

How Credit Scores Affect Car Loan Rates and Interest Paid

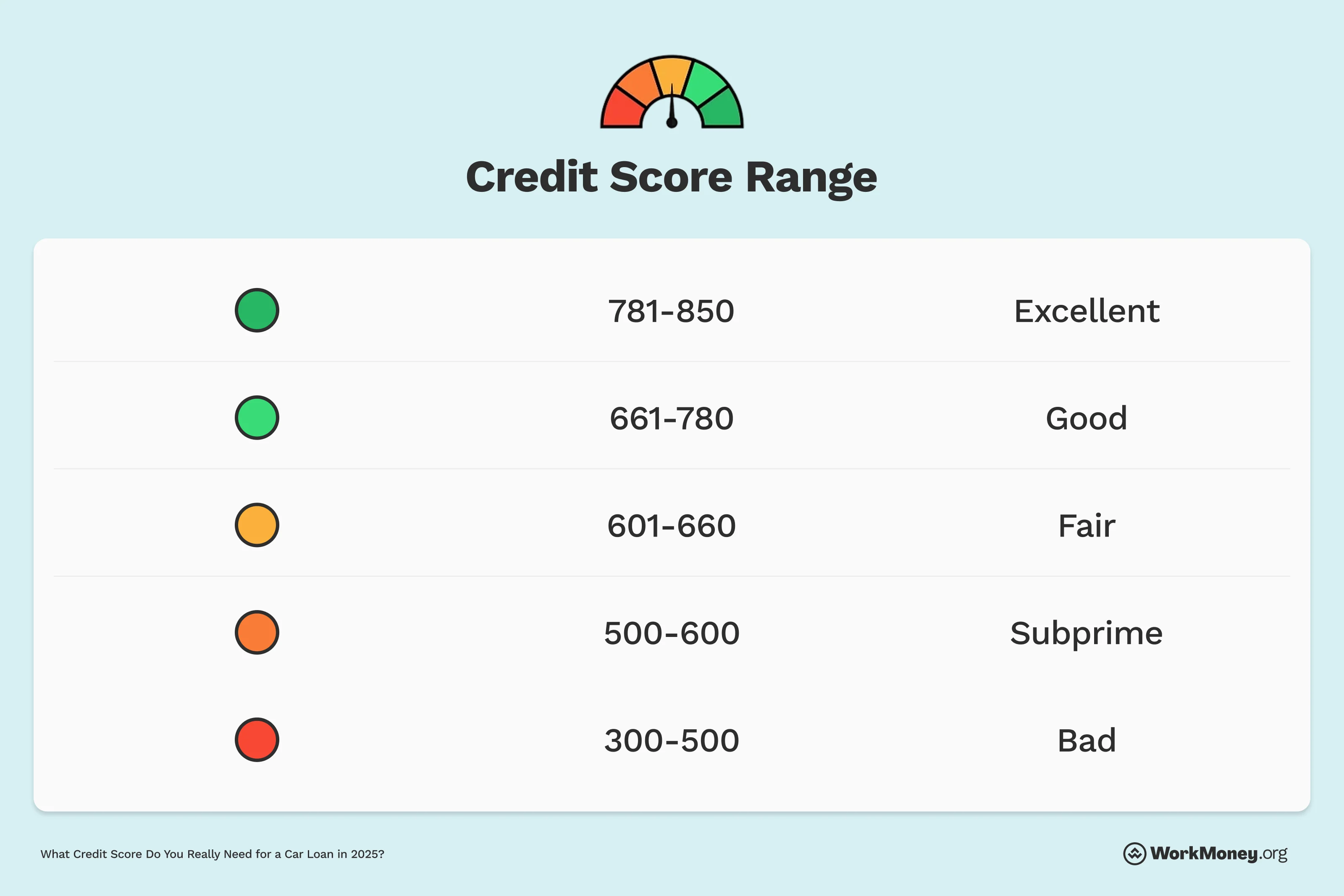

Your credit score is your report card from banks and other financial institutions on your reliability to pay your bills on time. Credit scores are measured on a scale from 300-850 – the higher the score, the better. And the higher your score, the better your interest rate will be on a car loan.

Here’s how much the APR differs for a new and used car based on your credit score, according to Experian VantageScore data:

Credit score range | New car loan APR | Used car loan APR |

781-850 (excellent credit) | 5.18% | 6.82% |

661-780 (good credit) | 6.70% | 9.06% |

601-660 (fair credit) | 9.83% | 13.74% |

500-600 (subprime credit) | 13.22% | 18.99% |

300-500 (bad credit) | 15.81% | 21.58% |

It’s hard to imagine what the total interest you would pay over the entirety of a loan. For this example, we will use the average car prices in 2025: $25,512 for used vehicles and $49,740 for new vehicles. For this example, we will assume a 10% down payment and a 6-year loan.

Credit score range | New car loan total interest paid | Used car loan total interest paid |

781-850 (excellent credit) | 5.18% ($7,412) | 6.82% ($5,081) |

661-780 (good credit) | 6.70% ($9,722) | 9.06% ($6,887) |

601-660 (fair credit) | 9.83% ($14,669) | 13.74% ($10,874) |

500-600 (subprime credit) | 13.22% ($20,311) | 18.99% ($15,675) |

300-500 (bad credit) | 15.81% ($24,813) | 21.58% ($18,165) |

Even jumping your credit score one category can make a significant difference in the total amount of interest you pay.

Tips to Improve Your Credit Before Applying

Before you apply for a car loan, the first step to take is to check your credit report. You can do that for free at AnnualCreditReport.com. This is an important step as you can gauge your credit score, and the factors influencing your current score. What’s more, many consumers have errors on their credit report, negatively affecting their scores. If you do find any errors, be sure to report them to the correct credit reporting agency. So, before applying for any financial products, be sure to check this to ensure you can qualify for the best products and rates available.

Next, be sure to pay down any credit card balances. These can negatively affect your credit score, especially if you’re using a significant amount of the credit given to you.

Lastly, be sure to give time between your last credit application and when you begin searching for an auto loan. Each time you apply for credit, you have a credit inquiry mark on your credit report. Banks don’t like to see consumers applying for credit repeatedly in a short time span, as it shows an increased need for borrowing.

Final Thoughts

Your credit score isn’t the only factor that will cause a bank to either approve or deny you for an auto loan. However, it can make a significant difference in how much interest you pay over the life of the loan.

So before you run to your local car dealership, the best thing you can do is pull your credit report to see where you currently stand. Analyze your report to see where you can improve. If your credit report looks solid, begin looking around different lenders to see who has the best rate and offer. Once you’re preapproved, you can start searching for the car you desire.

About the Author

Brett Holzhauer

Brett Holzhauer is a Certified Personal Finance Counselor (CPFC) who has reported for outlets like CNBC Select, Forbes Advisor, LendingTree, UpgradedPoints, MoneyGeek and more throughout his career. He is an alum of the Walter Cronkite School of Journalism at Arizona State. When he is not reporting, Brett is likely watching college football or traveling.