How Much Does Car Insurance Cost?

Find out what car insurance really costs and how to pay less. Your wallet will thank you

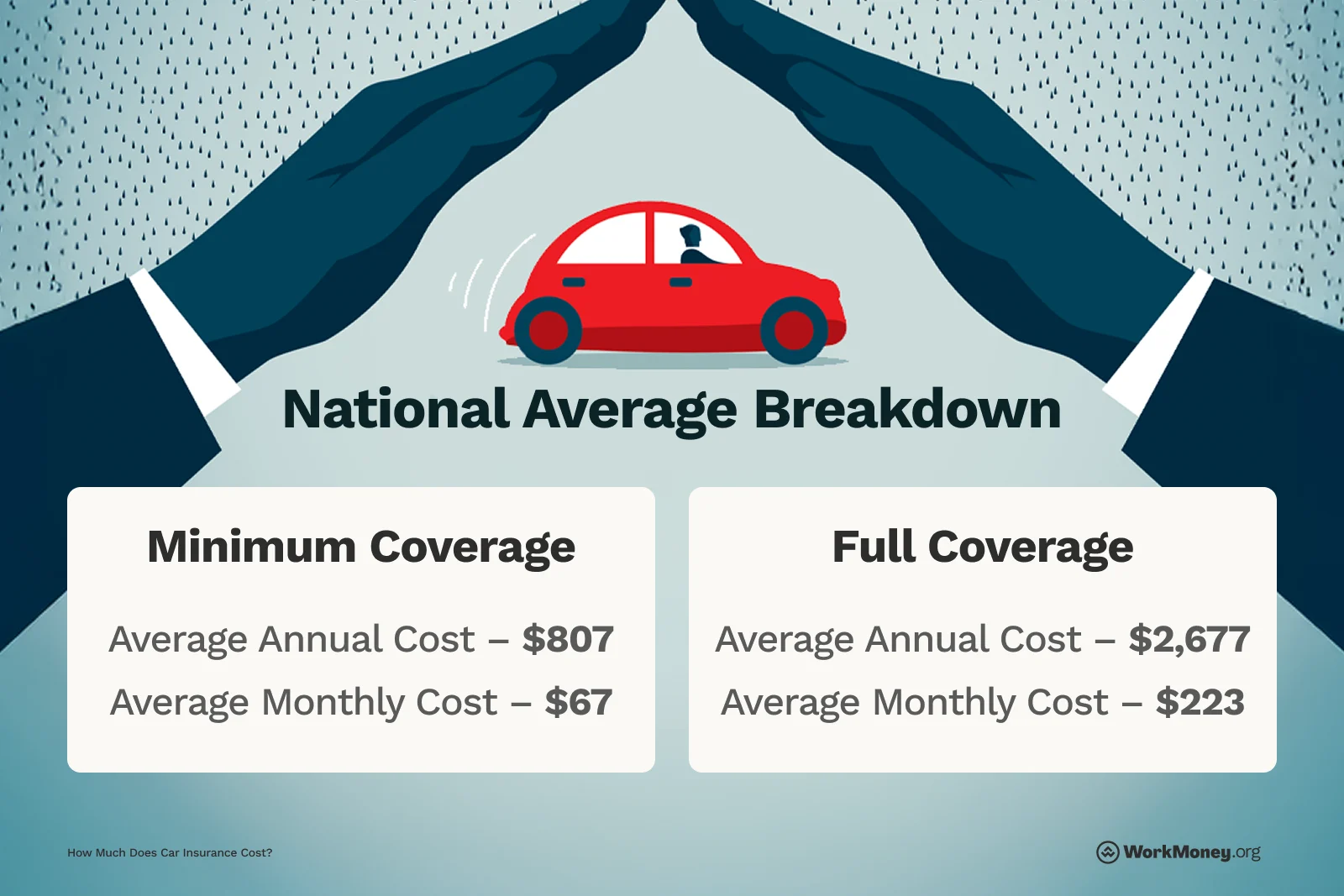

If you own a car, car insurance is one of those expenses you can’t skip. But that doesn’t mean you have to overpay for it. How much you'll pay for insurance will depend on different factors, like where you live, your driving record, and even your credit score. Fortunately, there are simple ways to lower your rate and keep more money in your pocket.

Whether you're new to buying car insurance or looking to save, the WorkMoney team is here to show you what it costs and how to get the best deal for your needs.

Savings Checklist

Use this quick reminder to help lower your insurance costs and create more room in your budget:

Compare insurance quotes at least once a year.

Try usage-based or pay-per-mile insurance if you drive infrequently.

Refinance your auto loan to free up cash for coverage.

Adjust the amount of coverage you buy as your car gets older.

Look into income-based assistance or state programs if you qualify

Final Thoughts

Buying car insurance doesn’t have to wreck your budget. Doing a little research, like comparing quotes, adjusting your coverage, or looking for discounts, can make a real difference.

Every dollar you save on insurance is a dollar you can put toward something else that matters, such as paying bills, building savings, or tackling debt.

About the Author

DeShena Woodard

DeShena Woodard is a Financial Freedom Coach, Certified Life Coach, freelance personal finance writer, and podcast host. Her story, advice, and expertise have been featured in prominent outlets such as CNN Underscored, Business Insider, Yahoo Finance, NerdWallet, and more. Through her platform, Extravagantly Broke, she helps women take control of their finances with simple, stress-free strategies—without sacrificing the joy of everyday life. When she’s not writing or coaching, DeShena enjoys traveling, biking, and spending time with her family.