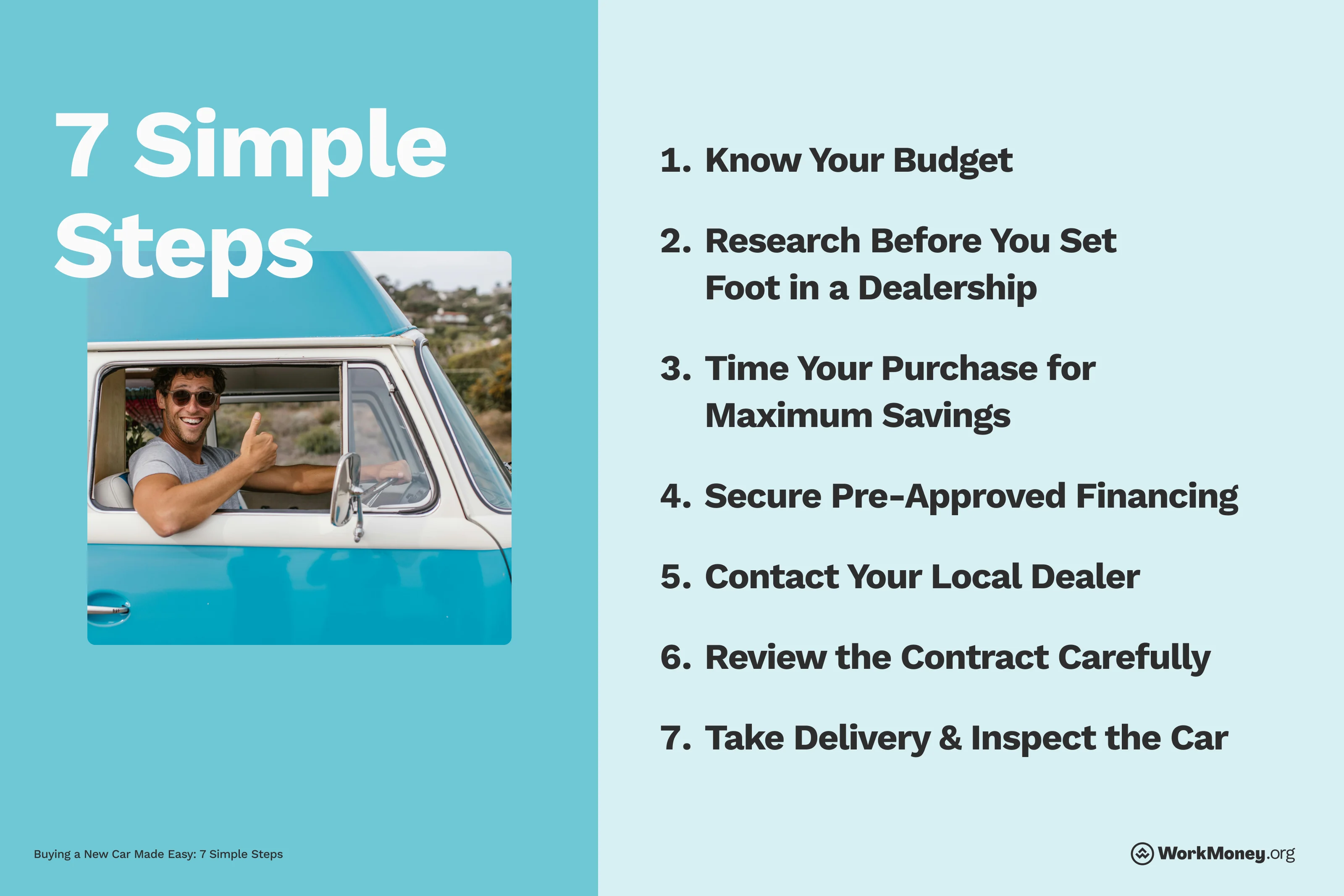

Buying a New Car Made Easy: 7 Simple Steps

Your roadmap to buying a car without stress or surprises

Buying a vehicle can feel like an overwhelming experience. From finding the right vehicle, negotiating with high-pressure sales representatives and knowing how it will impact your monthly budget can feel like too much to handle.

There are eight core steps to buying a new car, and the WorkMoney team has done a deep dive to walk you through it step by step – including a script that you can use to save you money.

Final Thoughts

There are several steps to take to have the best buying experience and ensure you get the best deal possible. But by being thorough and taking your time, you can avoid being ripped off and get a great deal on a new set of wheels.

About the Author

Brett Holzhauer

Brett Holzhauer is a Certified Personal Finance Counselor (CPFC) who has reported for outlets like CNBC Select, Forbes Advisor, LendingTree, UpgradedPoints, MoneyGeek and more throughout his career. He is an alum of the Walter Cronkite School of Journalism at Arizona State. When he is not reporting, Brett is likely watching college football or traveling.