Changes are Coming to Medicare in 2026 - What You Should Know

Your 5-minute guide to the new costs and savings coming to Medicare.

Health insurance changes every year, and Medicare is no exception. In 2026, some costs are decreasing while others are increasing. Earlier this year, Congress repealed the Inflation Reduction Act (IRA), which capped Medicare-related costs on out-of-pocket expenses and medications.

If you're getting Medicare or are preparing to enroll, WorkMoney has put together this guide to help you understand exactly what to expect with Medicare changes.

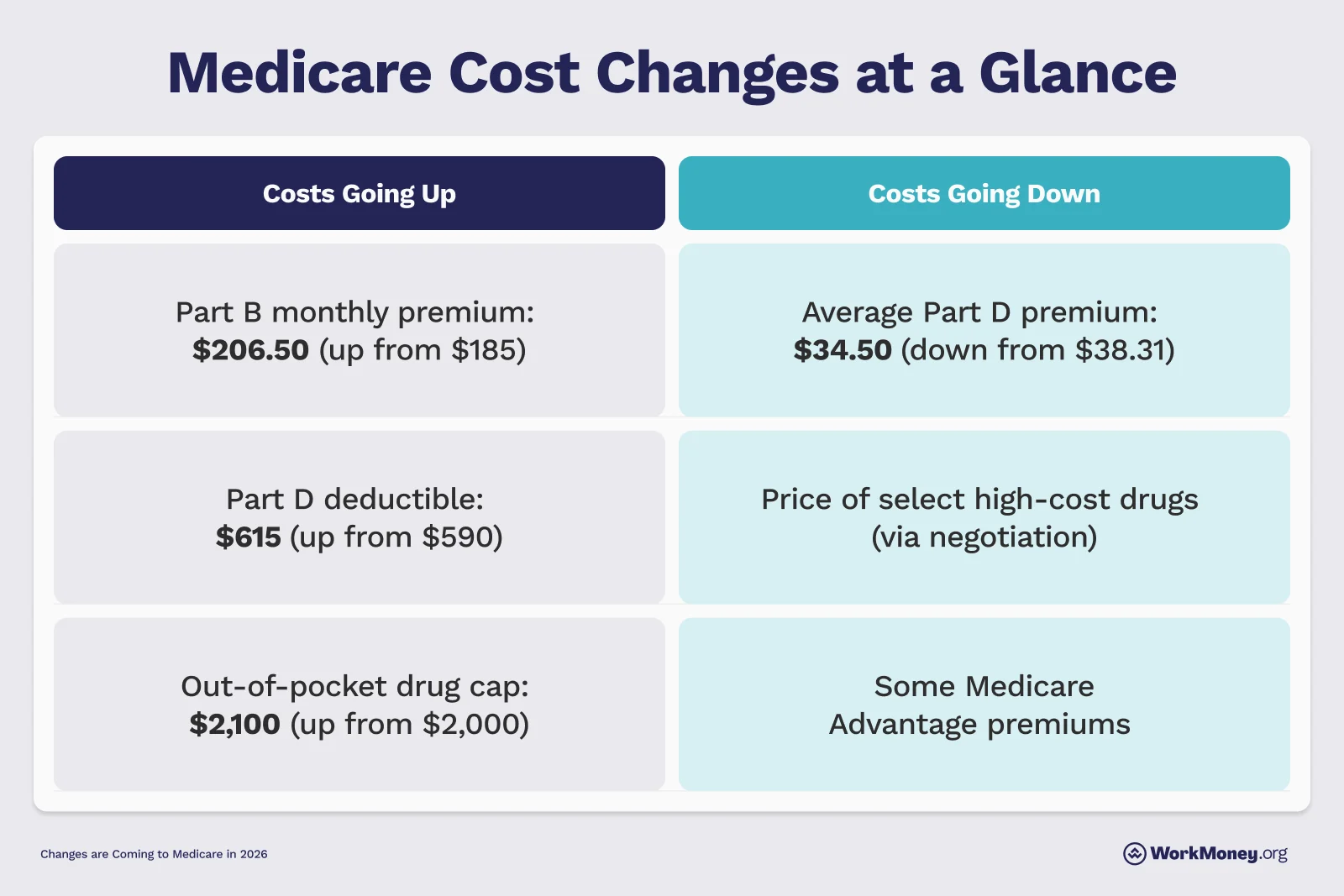

Medicare Cost Changes at a Glance

If you’re enrolling in Medicare or making changes to your plan, pay attention to what’s changing during open enrollment this year.

Costs Going Up | Costs Going Down |

Part B monthly premium: $206.50 (up from $185) | Average Part D premium: $34.50 (down from $38.31) |

Part D deductible: $615 (up from $590) | Price of select high-cost drugs (via negotiation) |

Out-of-pocket drug cap: $2,100 (up from $2,000) | Some Medicare Advantage premiums |

Costs Going Up

Most Medicare costs are rising in 2026, including Part B premiums, Part D deductibles, and out-of-pocket maximums on drug costs.

Part B monthly premium

Original Medicare includes two main parts: Part A, which is hospital insurance, and Part B, which is medical insurance. In 2026, part B monthly premiums will increase from $185 to $206.50. In 2024, it was $174 per month. That’s an extra $258 a year.

Part D deductible

Part D is a separate prescription drug plan. Original Medicare lets you add Part D, and Medicare Advantage usually includes it. Next year, costs will go up from $590 to $615. That’s a yearly increase of $300.

Out-of-pocket drug maximum

In 2025, the maximum Part D out-of-pocket prescription costs were $2,000. For 2026, it’ll go up to $2,100. This is the amount you’ll pay on prescription drugs until insurance kicks in.

You can spread these costs into equal monthly payments through a prescription payment plan. This is an optional payment choice; if you don’t want it, you’ll need to opt through your insurance provider.

What’s Going Down

There are some Medicare changes where costs are dropping, including Part D premium averages, some drug costs, and Medicare Advantage plan premiums.

Average Part D premium

Average standalone Part D premiums will drop from $38.31 to $34.50. The $3.81 monthly drop will save you almost $46 a year.

You can get Part D in addition to Original Medicare. If you have Medicare Advantage, it’s usually included in your plan, as well as other, lower out-of-pocket costs.

Price of select high-cost drugs

The Inflation Reduction Act allows Medicare to negotiate the cost of some drugs with pharmaceutical companies. Right now, that’s only 10 drugs, including:

Eliquis

Enbrel

Entresto

Farxiga

Imbruvica

Jardiance

Januvia

NovoLog

Stelara

Xarelto

These are the first 10 drugs that will get lower prices in Medicare, and another slate of prescriptions will come in 2027. Right now, the savings on these medications will save consumers $1.5 billion in out-of-pocket spending in 2026.

Some Medicare Advantage premiums

Medicare Advantage is a privately run Medicare alternative to Original Medicare. It isn't going away, but enrollment is expected to drop from 34.9 million to 34 million in 2026. Right now, about half of Medicare beneficiaries are enrolled in Medicare Advantage.

The monthly costs for Medicare Advantage premiums are decreasing from $16.40 to $14. This $2.40 drop will save enrollees less than $30 a year.

How to Budget for Medicare Changes

With many Medicare costs going up in 2026, preparing for these major financial changes is essential.

The Bottom Line

Some significant Medicare changes are happening in 2026, including plan adjustments, premium hikes, and drug price negotiations. It’s important to review your current plan to see how these changes impact your coverage.

Review your current plan during open enrollment and compare it to other options available for the new year. See what you’re eligible for and talk to your doctor about how to make plan adjustments to save money, as Medicare increases could hurt you in 2026.

About the Author

Dori Zinn

Dori Zinn is a longtime personal finance journalist with nearly 20 years of experience in digital media. Her work has been featured in the New York Times, Wall Street Journal, CBS News, Yahoo, CNN, USA Today, and more. She loves helping folks learn about money. If she isn’t writing, she’s reading, baking, or watching football.