How To Get Medical Debt Forgiven

Drowning in medical bills? Learn how to reduce or erase your debt through forgiveness programs, payment plans, and free nonprofit help—even if you’re uninsured.

Few things can affect your family like an unexpected or major medical issue. Not only because of the physical and emotional stress it causes, but also it can be really tough on your wallet, especially if you don’t have insurance or your plan doesn’t cover it. In fact, every year, around 100 million people in the U.S. find themselves swamped with medical debt.

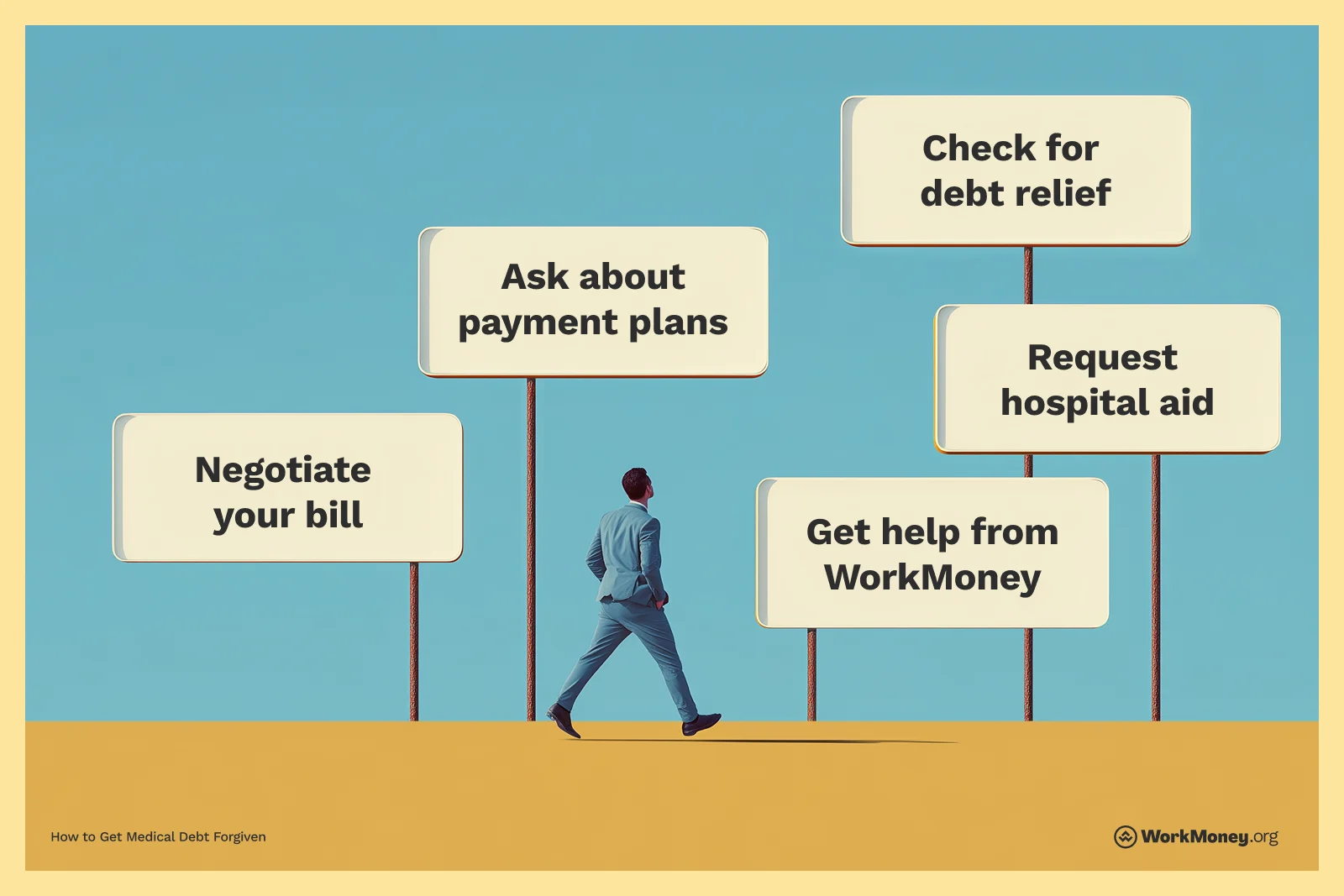

But don't lose hope yet. With our trusted partner, Dollar For, you can take advantage of the following ways to forgive your medical debt.

Check If You're Eligible for Medical Debt Relief

One possible way to lower your medical bills is to qualify for special circumstance debt relief. For example, if you're 65 years old or older, there are lots of medical debt relief options through Medicare and Medicaid available that can erase your medical debt.

Even if Medicare doesn't pick up the tab for an expense, there could be services to help you reduce medical payments and out-of-pocket costs. For example, the State Health Insurance Assistance Program (SHIP) offers free counseling and support to Medicare recipients to help them better navigate the options available.

Also, if you're a veteran, or recovering from addiction, or dealing with a chronic illness, there are medical debt forgiveness programs designed for you, like charity care programs, that can help reduce or erase your medical debt.

Work Out a Payment Plan

Another path to debt forgiveness could be negotiating a payment plan. Give the hospital or doctor’s office a call and work out a payment schedule of manageable, regular payments.

A good repayment plan should have low fees and low interest rates, helping you reduce additional costs. Making consistent debt payments can help you negotiate to have the rest of your debt forgiven.

Your Bill Might Not Be Set in Stone

Often, people think that the bill they get is final. But that’s not true! The standard fee that hospitals and doctors’ offices first charge is a starting point for negotiations.

Usually, insurance companies negotiate these costs down significantly. But if you don’t have insurance or require treatments not covered by insurance, you might be handed a hefty bill. The good news is you can still negotiate these costs!

Start by reviewing your bill for any mistakes, as hospitals may have charged for treatments you didn’t even receive or for duplicate procedures. If something looks off, call the hospital or doctors’ office and ask about reducing or removing charges.

Ask The Hospital If They Can Cover Costs If It’s Too Expensive

Many hospitals, especially the nonprofit ones, have programs to help people who can’t afford essential medical care. If your bill feels overwhelming, you may qualify for debt forgiveness– but you’ll need to apply and work with the hospital to lower your medical costs.

That’s where Dollar For can come in! They can guide you through these hospital policies to reduce your medical debt and help you apply for debt forgiveness. They can also help you understand the complex terms and check eligibility, all while helping you prep and file your application. Best of all, these programs are often completely free, so you can focus on your health instead of worrying about medical debt.

Lighten Your Medical Debt Load with WorkMoney

Here at WorkMoney, we've teamed up with Dollar For to help you manage your medical debt and return to a more solid and secure financial footing. But that’s just the start. Explore the benefits of being a WorkMoney member, like smart ways to save on groceries, gas, and prescription meds.