What a Monthly Electric Bill Really Costs

Electric bills are rising, but that doesn’t mean you’re stuck paying more. Learn what’s driving your costs and how to save with smart strategies and programs.

Keeping the lights on costs a pretty penny, but it’s an essential utility that households require to function properly and safely. Which is why it can be so frustrating if you watch your electric bill rise again and again.

If your electric bill keeps rising, you’re not alone. Many people are paying more than they should, and the WorkMoney team is on a mission to fix that. Let’s break down what a typical electric bill looks like, what drives the cost up, and how you can shrink your monthly payment with the help of simple tools and programs.

What’s the Average Monthly Electric Bill?

The average U.S. household electric bill is about $149 per month, that’s about $1,788 per year. How much you will actually pay for electricity each month depends on many factors like your usage habits, the size of your home, and your electric rate (measured in cents per kilowatt-hour or kWh).

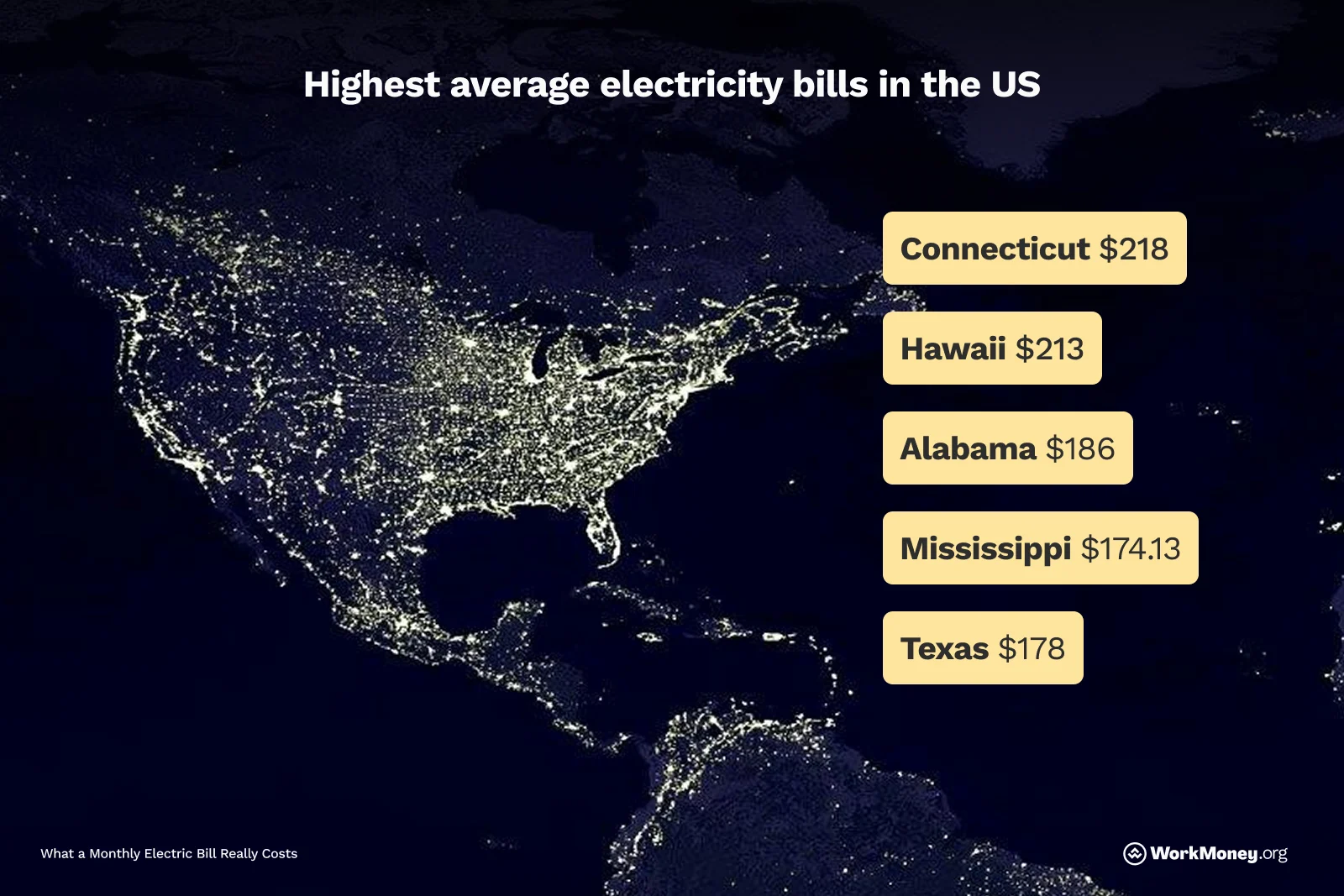

Location also plays a role. The state you live in can impact your energy spending and if you live in one of these five states, you’re looking at the highest average electricity bills in the country.

Connecticut: $218

Hawaii: $213

Alabama $186

Mississippi: $174.13

Texas: $178

If you’re lucky and live in one of these states, your state is spending the least on average for electricity bills.

Utah: $95

New Mexico: $95

Colorado: $103

Wyoming: $113

Montana: $107

Why Your Bill Changes Month to Month

Does budgeting for an electric bill feel out of reach due to a monthly bill balance that ebbs and flows? Even if you don’t adjust your electricity usage much on a day-to-day basis, it’s very common for your bill to vary in amount from month to month. That’s because your electric bill is more than how much power you use. It includes:

Supply charges: What you pay for the actual electricity

Delivery charges: What the utility charges to send that power to your home

Fees and taxes: These costs can add up, especially in cities or high-tax states

Weather changes: Seasonal usage plays a big role too and you likely pay more in summer, when air conditioners run all day and winter if your home uses electric heat

Step-by-Step: How to Estimate Your Own Bill

If you want to get a clearer picture of what your energy bill will look like this month, you can use a simple formula to figure out your typical cost:

Check your last bill. Confirm what your monthly kWh use is

Look up your local rate. Check your utility’s website or use PowerOutage.us

Use this formula:

kWh used × cents per kWh = supply cost

Add delivery and fees (typically 25%–40% extra).

Let’s look at an example of a household using 800 kWh of electricity each month:

800 kWh × $0.16 = $128

Add 30% (fee estimate) to $128 = $167 total bill

How to Save on Electricity

There are plenty of companies that promise to sell you the perfect gadget or service to cut down your energy spending, but you don’t need to spend money to save.

Compare Plans and Rates

If you live in a deregulated state, you can choose your power supplier. That means you can shop for the lowest rate—just like comparing phone plans. Services like Arbor find the cheapest rate automatically and switch you with no hassle. WorkMoney members save up to $593 per year when they switch to Arbor with no service interruptions.

When searching for a new electricity provider, look for:

No early cancellation fees. That means you can switch providers any time if a cheaper option pops up.

Fixed rates (not variable). Your price per kilowatt-hour stays the same all year, even when energy markets spike.

No added “rider” charges. Riders are extra fees hidden in fine print—avoiding them keeps your bill more predictable.

Use Government Aid Programs

Your income level may qualify you for government programs that offer help paying for electric bills. for help paying your bill. These programs are your right—not handouts. Many people qualify for federal or state programs (some states cap electricity rates or offer discounts for seniors, families with kids, and individuals with medical equipment). For example, the LIHEAP (Low Income Home Energy Assistance Program) helps with energy costs for qualified households. You can apply through your state agency or visit Benefits.gov.

If you qualify for Lifeline phone assistance, you may also be able to stack power bill help in certain states.

Shift Use to Off-Peak Hours

Many utilities offer time-of-use plans, where prices are higher during peak hours (like weekday afternoons) and lower at night. If you do your laundry or charge your devices at night, you can save on electricity. Pair those efforts with a programmable thermostat, and you can save even more.

Go Solar

Solar panels are cheaper than ever thanks to the Residential Clean Energy Credit and can save you an average of $1,500 per year on energy bills. As helpful as solar panels are, they don’t need to be on your home’s roof for you to save. Lean into community resources to save. In some states, you can subscribe to a local solar project and get credit on your bill—up to 10% off—without installing anything. Before you make any kind of movement toward solar energy, get a few quotes from different providers.

Not sure if solar is worth the investment? Sites like EnergySage give free quotes and show how much you’d save over time.

Know Your Options

Some utilities push “budget billing,” where you pay the same amount every month. While it helps avoid big surprises, it can raise your total costs by adding administrative fees in some cases. You’re better off switching to smarter rate plans or reducing usage. Even better wins can come from time-of-use plans matched with programmable thermostats, which give you the benefit of limiting electricity use to times of day when it’s cheaper.