Energy Saving Tips That Cut Bills Fast

These fast, simple energy tips can cut your costs, starting today

Energy costs are climbing fast, and for renters and working families already stretched thin, even small increases can hit hard. This summer, the average U.S. home electricity bill is expected to hit $784—up over 6% from last year and marking a 12-year high, according to the National Energy Assistance Directors Association (NEADA).

At the same time, inflation is driving up the cost of everyday essentials—groceries, gas, rent—making it feel like everything’s getting more expensive at once. If you're feeling the pressure, you’re not alone.

That’s why the WorkMoney team created this guide: to help you identify fast, no-nonsense energy-saving actions you can start today. No expensive upgrades. No special tools. No complicated instructions. Just smart, proven fixes that lower your bills—without sacrificing comfort.

Saving money on your energy bill shouldn’t be complicated. It should be simple, doable, and start now.

Energy Sprint: 4 No-Cost Moves That Save $180 a Year

If you’re looking for quick ways to slash your utility bills, start with an Energy Sprint. These are four simple, proven actions you can take today to start saving fast. WorkMoney tested this sprint with members across four climate zones and found it can cut energy costs by an average of $180 per year—all without sacrificing comfort.

The best part? They’re quick, free, and beginner-friendly:

Lower your water heater to 120°F

Install two smart power strips (many utilities send them for free!)

Seal attic or closet doors with adhesive foam

Turn on time-of-use pricing (if available in your area)

Action | Time | Annual Savings | How-To |

|---|---|---|---|

Drop water heater to 120°F | 2 minutes | ~$36/year | |

Installing 2 smart power strips | 10 minutes | ~$40/year | |

Seal attic or closet doors with adhesive foam | 15 minutes | ~$50/year | |

Turn on time-of-use pricing (if available) | 5 minutes | ~$50+/year |

Savings Straight to Your Phone: Sign up for WorkMoney’s text reminders to complete your sprint this week.

Fast Habits With Big Impact

Some of the best energy savings come from quick, everyday changes like washing clothes in cold water, reversing your ceiling fan in winter, and unplugging chargers can all lower your bill. If you want to take it a step further, taking 30 minutes to seal door gaps, clean fridge coils, or close vents in unused rooms can also lead to savings that add up.

Task | Time to Complete | Estimated Annual Savings |

|---|---|---|

Wash clothes in cold water | 0 min | ~$60/year |

Unplug chargers when not in use | 0 min | Varies; small but adds up |

Use ceiling fan in winter (reverse spin) | 2 minutes | ~3% reduction on heating bill |

Keep freezer full | 5 minutes | Modest savings; improves efficiency |

Seal door gaps (towels or weatherstrip tape) | 20 minutes | ~$20–$50/year |

Close vents in unused rooms | 10 minutes | ~$10–$20/year |

Clean fridge coils and HVAC filters | 30 minutes | ~$15–$30/year |

Use curtains to block/let in heat (seasonally) | 10 minutes (adjust daily) | ~$15–$30/year |

WorkMoney Tip: Many utilities offer free weather-sealing kits and LED bulbs by mail. Use our free Money Finder tool to grab your freebies and start saving fast.

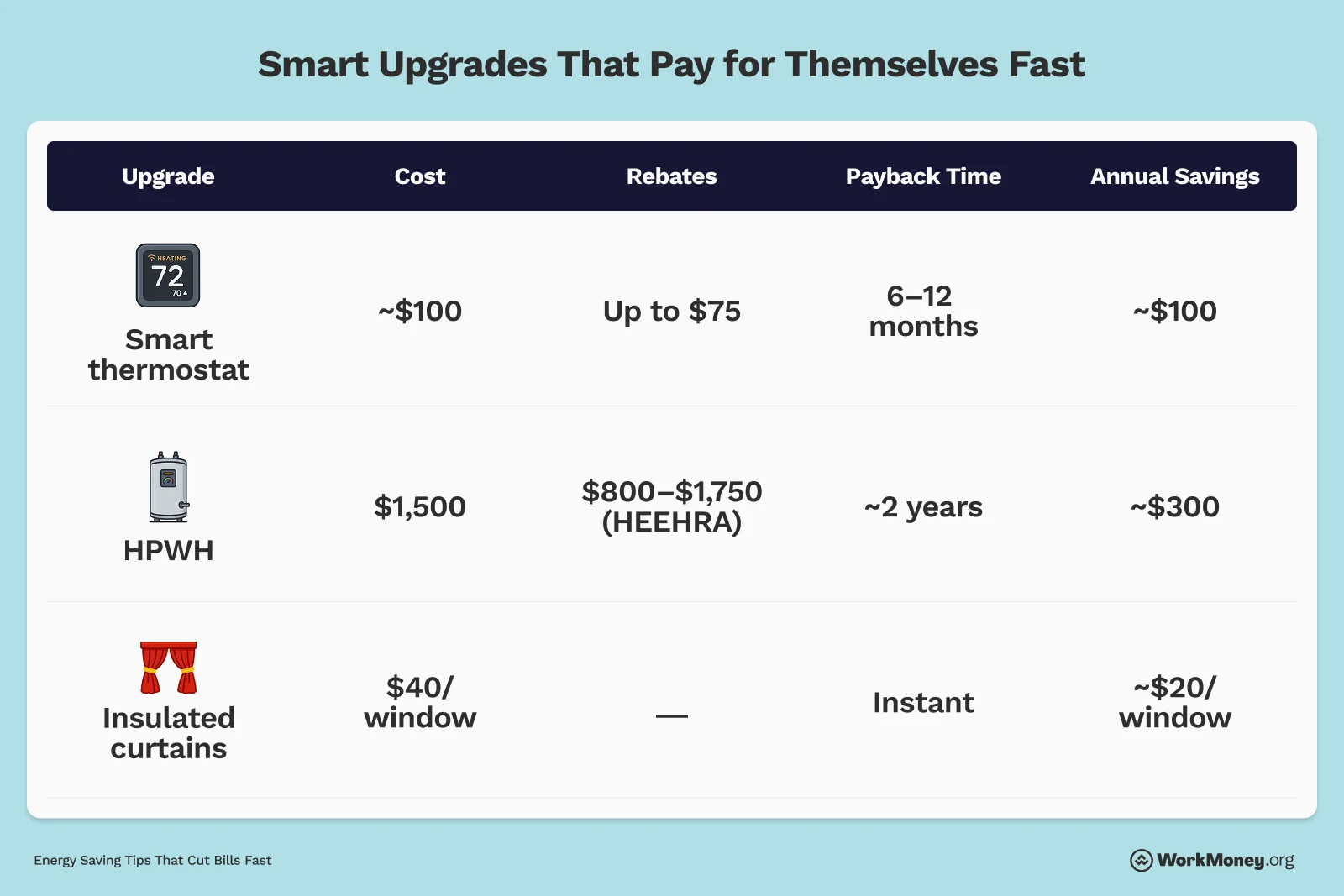

Smart Upgrades That Pay for Themselves Fast

If you’re able to make a few upgrades, the long-term savings can be well worth it. While some of these changes come with upfront costs, many pay for themselves over time.

Upgrade | Cost | Rebates | Payback Time | Annual Savings |

|---|---|---|---|---|

Smart thermostat | ~$100 | Up to $75 | 6–12 months | ~$100 |

Heat pump water heater | $1,500 | $800–$1,750 (HEEHRA) | ~2 years | ~$300 |

Insulated curtains | $40/window | - | Instant | ~$20/window |

If you're considering home upgrades like heat pump water heaters or smart thermostats, don’t miss out on valuable rebates. The HEEHRA program (High-Efficiency Electric Home Rebate Act) offers major discounts on energy-efficient appliances—especially for low- to moderate-income households. On top of that, many local utilities provide additional rebates that can significantly lower your out-of-pocket cost.

Need help figuring out what applies to you? Check out Arbor and Energy Sage. They offer tools to compare upgrades, calculate savings, and show which rebates are available in your area so you can make the smartest choice for your home and budget.

Benefits & Rebates

If high energy bills are stretching your budget, you may qualify for powerful federal and state programs designed to help. These aren't handouts—they're funded by your tax dollars, and claiming them is your right.

LIHEAP (Low-Income Home Energy Assistance Program): Helps income-eligible households pay their heating or cooling bills, especially during extreme weather months. Some states even offer emergency support or weatherization help through this program.

HEEHRA (High-Efficiency Electric Home Rebate Act): Offers up to $14,000 in rebates for switching to energy-efficient electric appliances like heat pumps, induction stoves, and upgraded wiring. This is a game-changer for families looking to cut costs long-term while modernizing their home.

Free Smart Plugs and Kits: Many utility companies will send you free energy-saving tools—like smart plugs, LED bulbs, and weather-sealing kits—just for asking. These simple tools can make a noticeable difference on your next bill.

Final Tips

Remember, this isn’t about sacrifice—it’s about comfort, control, and keeping more money in your pocket. Small, smart changes can make a big difference, and the best part? You can start today.

Know someone else who could use help lowering their bills? Share WorkMoney with friends and family so everyone can save together.

About the Author

Brett Holzhauer

Brett Holzhauer is a Certified Personal Finance Counselor (CPFC) who has reported for outlets like CNBC Select, Forbes Advisor, LendingTree, UpgradedPoints, MoneyGeek and more throughout his career. He is an alum of the Walter Cronkite School of Journalism at Arizona State. When he is not reporting, Brett is likely watching college football or traveling.