Cheapest Way to Rent a Car Without Overpaying

Stretch your dollars on wheels: tips for the lowest‑cost car rental

Whether you're planning a road trip, taking a vacation, moving to a new place, or just need a car while yours is in the shop, rental costs can add up fast.

WorkMoney has pulled together some of the smartest ways to help you score the lowest rates, avoid extra fees, and keep more of your money in your pocket.

How Much Does a Rental Car Cost?

As of 2025, the average daily price for an economy rental car in the U.S. ranges between $49 and $78, with weekly rates typically falling between $343 and $546. Renting a luxury car can cost as much as $150 per day.

However, prices can vary significantly depending on several different factors. For instance, when you book, the location where you're picking up the car, the vehicle class you choose, and even the driver's age all play a part. Extras like GPS, toll passes, and additional drivers can also push that price even higher.

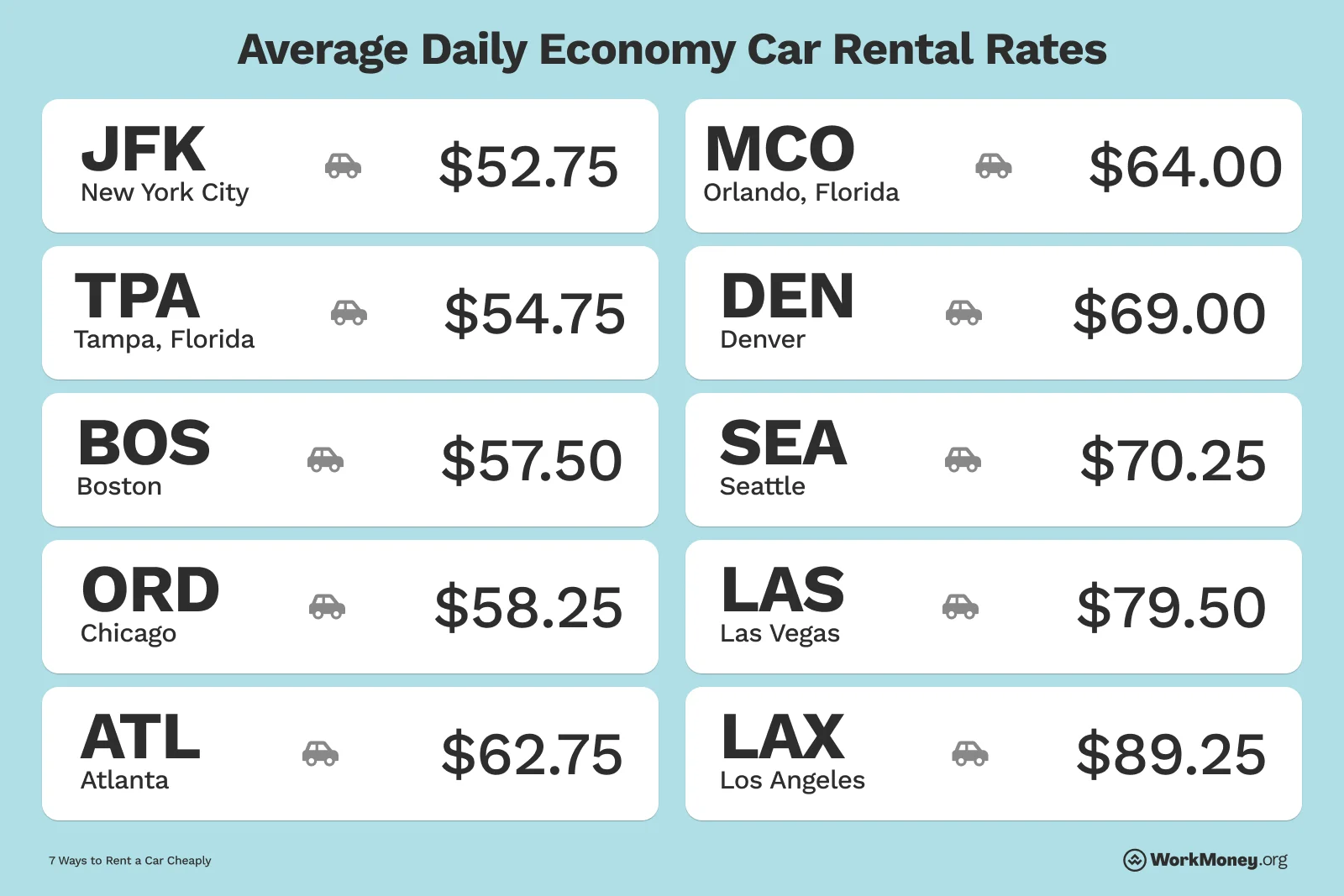

According to research by Fidelity, here’s what a week-long rental of an economy car might cost at 10 popular U.S. airports (prices adjusted to May 2025):

City (Airport Pickup) | Average Daily Rate (Economy) |

New York City (JFK) | $52.75 |

Tampa, Florida (TPA) | $54.75 |

Boston (BOS) | $57.50 |

Chicago (ORD) | $58.25 |

Atlanta (ATL) | $62.75 |

Orlando, Florida (MCO) | $64.00 |

Denver (DEN) | $69.00 |

Seattle (SEA) | $70.25 |

Las Vegas (LAS) | $79.50 |

Los Angeles (LAX) | $89.25 |

Below are some of the cheapest ways to rent a car without overpaying, so it fits into any budget.

Final Thoughts

Finding the cheapest way to rent a car without overpaying is possible with a few smart moves. Before you book your next rental car, take a few minutes to compare prices across websites. You can also save by choosing an off-airport pickup location and checking for any discounts through memberships or credit cards.

Small steps like using cashback apps, skipping unnecessary add-ons, or choosing peer-to-peer rentals can lead to big savings. The more informed you are, the more money stays in your pocket, right where it belongs.

About the Author

DeShena Woodard

DeShena Woodard is a Financial Freedom Coach, Certified Life Coach, freelance personal finance writer, and podcast host. Her story, advice, and expertise have been featured in prominent outlets such as CNN Underscored, Business Insider, Yahoo Finance, NerdWallet, and more. Through her platform, Extravagantly Broke, she helps women take control of their finances with simple, stress-free strategies—without sacrificing the joy of everyday life. When she’s not writing or coaching, DeShena enjoys traveling, biking, and spending time with her family.