Smart Ways to Teach Your Kids About Money Early On

Effective strategies for raising financially savvy children from an early age

One minute you’re rocking your baby in your arms—then you blink and they’re off to college. Time flies when you’re busy raising a family, which is why you need to prioritize teaching as many important life lessons to your littles while you still have their attention. Especially when it comes to money.

The good news? You don’t need to be a financial expert or wealthy to raise financially savvy kids. The WorkMoney team has put together a few ways you can teach your kids about money while they’re young.

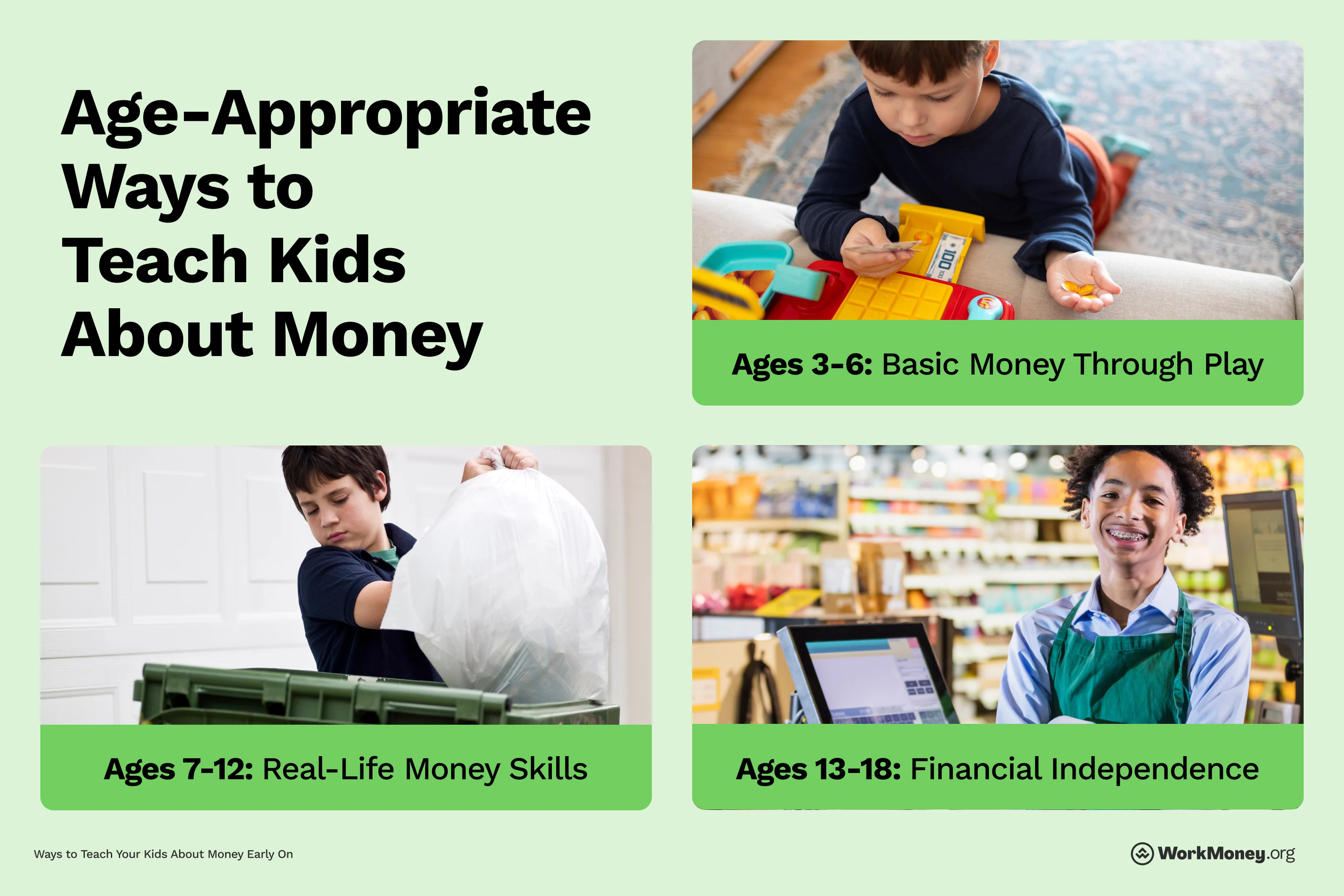

Age-Appropriate Ways to Teach Kids About Money

You may have been raised in a home where money wasn’t a positive subject, but being open about money is the best way to introduce your children to the financial concepts they need to understand to live well. How you approach money conversations with your kids will differ depending on how old they are.

Get the Whole Family In on the Fun

Teaching kids about money doesn’t have to be all lectures and lessons—turn it into a fun, hands-on activity the whole family can get excited about. One great way to do this is by starting a family savings challenge. Whether you’re working toward a small treat, like a pizza night, or saving up for something bigger, like a weekend trip or new household item, setting a shared goal teaches valuable money lessons and brings everyone together.

Here’s how to make it engaging:

Choose a shared goal: Let everyone weigh in on what you’re saving for. It could be as simple as movie tickets or as ambitious as new bikes for the kids. When everyone has a say, they’re more invested in reaching the goal.

Set a target amount and deadline: Break the goal down into a specific amount with a realistic timeframe. For example, “Let’s save $50 for ice cream and a park day over the next month.

Track progress visually: Kids and adults alike love seeing progress. Create a simple chart, sticker board, or coloring sheet where you fill in sections as you save. You can even use a clear jar to watch coins and bills add up.

Celebrate milestones: If your goal takes time, set small rewards along the way. For instance, when you hit the halfway mark, enjoy a fun, free or low-cost activity to stay motivated.

Encourage contributions: Find age-appropriate ways for kids to pitch in. That could be doing extra chores, saving part of their allowance, or collecting spare change. Even small contributions build pride and ownership.

The Long-Term Impact of Early Financial Education

New results from the Program for International Student Assessment (PISA) reveal that about one in five U.S. teenagers—or 22%—do not have basic financial literacy skills. The best thing parents can do to avoid their teen falling into this category is to keep lines of communication open.

Starting money conversations early pays off and can help young adults better manage credit and debit. For lower and middle-income families, these skills can make a significant difference. Financial literacy empowers kids to avoid predatory loans, manage student debt, and consider government benefits when needed.

When having these important money conversations, tailor the lessons to your family’s situation. The relevancy can make it easier for your child to understand the financial lessons you want to impart on them. When chatting about money related topics:

Focus on needs versus wants: Especially when budgets are tight, help kids understand prioritizing essentials like food, shelter, and bills.

Celebrate small savings victories: Even saving $1 or $5 shows kids the power of building toward a goal.Be honest about challenges: If money is tight, frame it as a temporary situation, but use it as a chance to teach resourcefulness and planning.

Teach them about their rights: Government benefits—like SNAP, Medicaid, or housing assistance—aren’t handouts. They’re programs you earned through taxes and hard work. Explaining these programs to your children helps normalize financial ups and downs and reduces the stigma around asking for help.

Some parents find it challenging to talk about money, but by making money part of everyday life, you’ll help your children grow into adults who feel empowered, not overwhelmed, by financial decisions.

About the Author

Jacqueline DeMarco

Jacqueline DeMarco is a seasoned personal finance writer with over seven years of expertise covering important financial topics like credit cards, budgeting, banking, and insurance. Her work has been featured by top financial brands and publications, including Newsweek, Fortune, USA TODAY Blueprint, Bankrate, CreditCards.com, SoFi, and Northwestern Mutual.