How to Easily Budget for Your Home Renovation

Make your dream home a reality without emptying your wallet

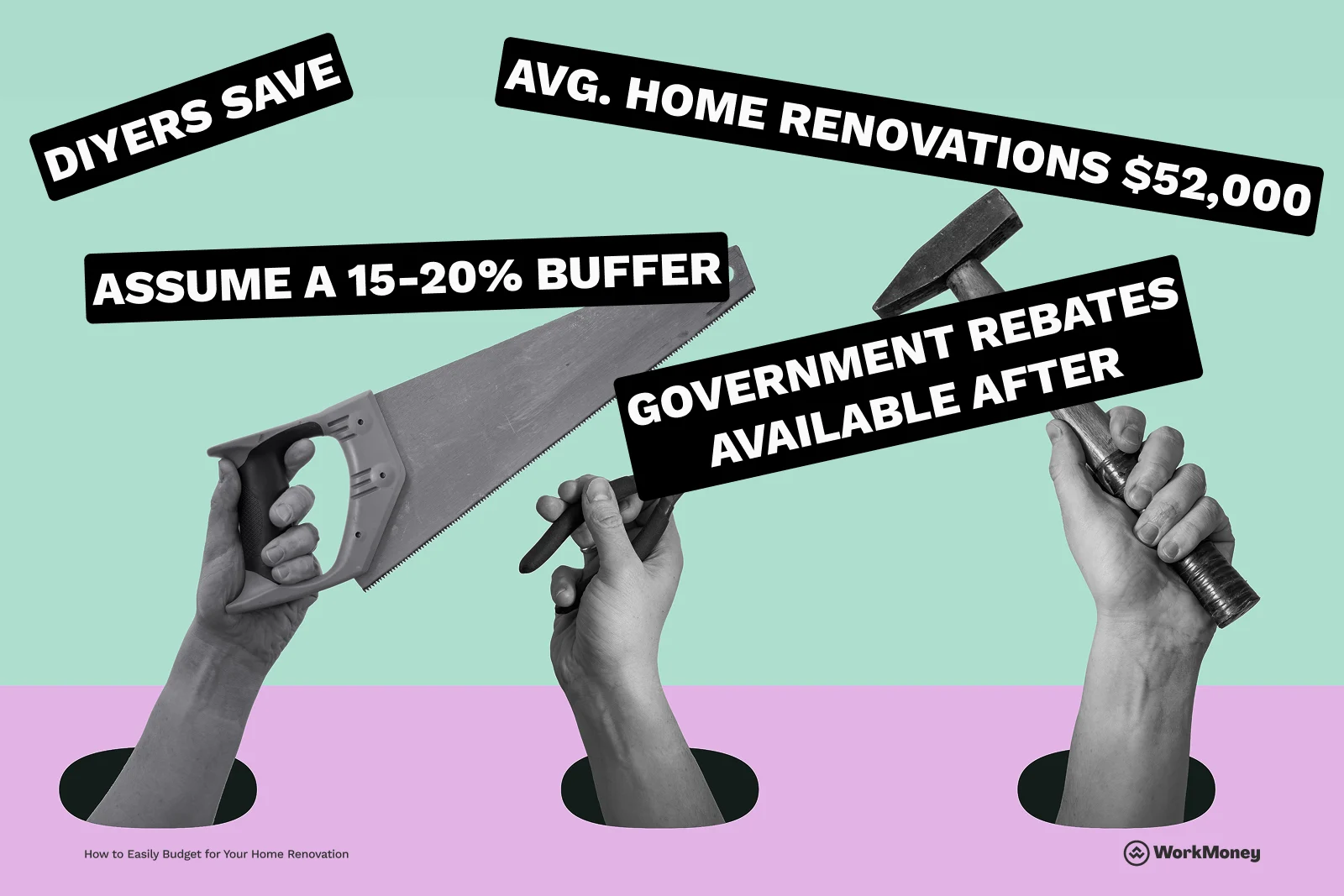

Home renovations can be exciting—and overwhelming. Costs can mount quickly and leave project budgets in shambles.

The good news is that making affordable home renovations is possible when you have the right plan. With a simple checklist and a few money-saving tools, you can stretch your dollars further than you think.

At WorkMoney, we’re here to help you get the most from your money—so your renovation feels less like a burden and more like a smart investment.

Final Thoughts

Home renovations don’t have to cost a fortune. With a smart plan, a little research, and a few simple savings tools, you can stay in control without breaking the bank. Start by setting clear goals, separating needs from wants, and building in a cushion for surprises. Don't forget to take advantage of rebates, tax credits, and partner programs that help put money back in your pocket.

At WorkMoney, we’re here to help you stretch every dollar so you can focus on what matters most—turning your house into a safer, more comfortable home you love.

About the Author

DeShena Woodard

DeShena Woodard is a Financial Freedom Coach, Certified Life Coach, freelance personal finance writer, and podcast host. Her story, advice, and expertise have been featured in prominent outlets such as CNN Underscored, Business Insider, Yahoo Finance, NerdWallet, and more. Through her platform, Extravagantly Broke, she helps women take control of their finances with simple, stress-free strategies—without sacrificing the joy of everyday life. When she’s not writing or coaching, DeShena enjoys traveling, biking, and spending time with her family.