How Much Americans Actually Spend on Food Each Month

Whether dining out or cooking at home, food is typically one of the largest line items in most American households.

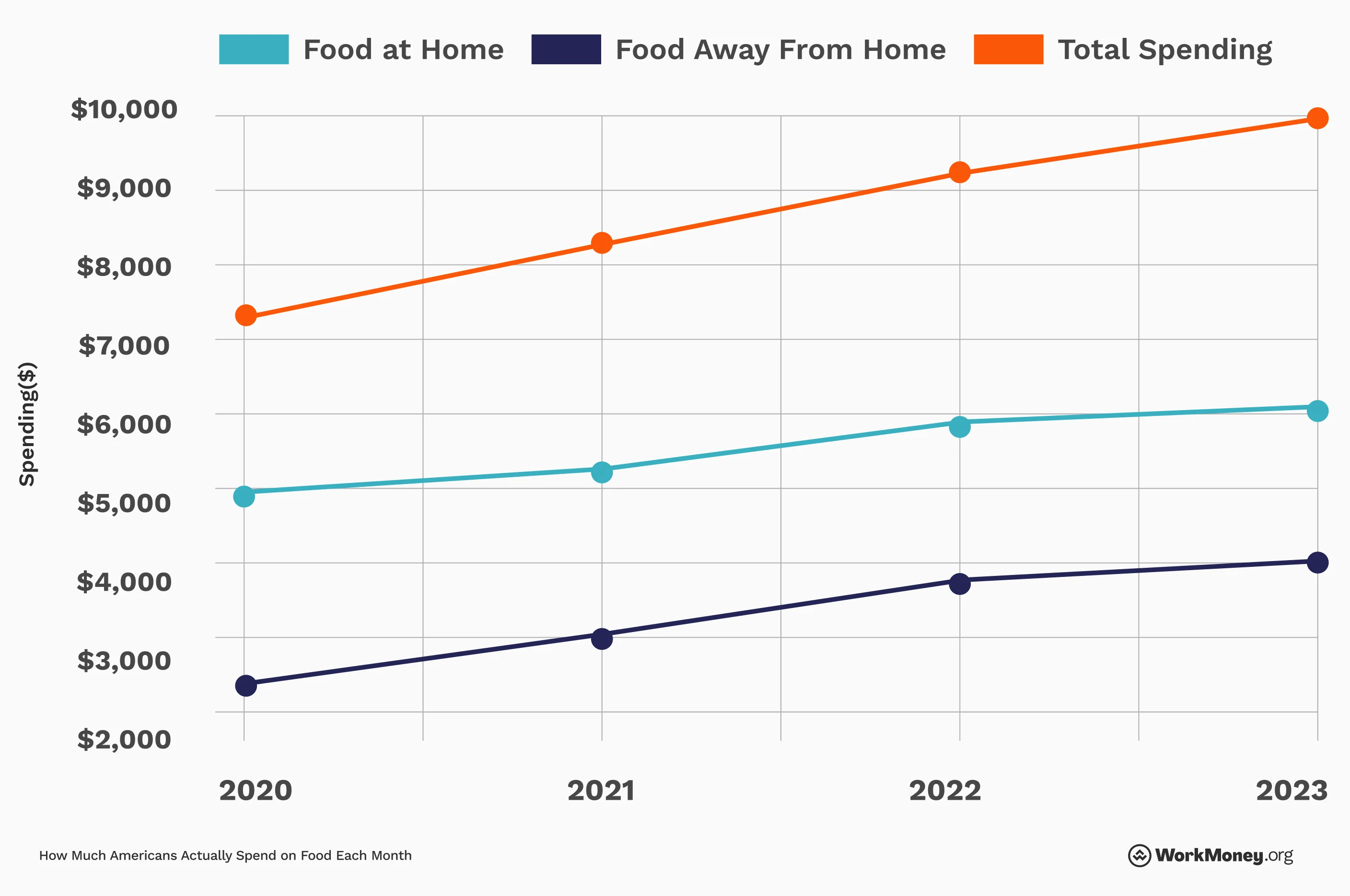

There are several estimates of how much everyday Americans spend, but these figures can vary widely based on location, shopping habits, and the types of purchases made. In 2023, the Bureau of Labor Statistics reported that the average annual expenditure on food was $9,986, or approximately $832 per month. Two years later, inflation has likely increased that number to over $10,000.

Again, this number can vary widely. It’s wise to use these numbers as a barometer of where you sit based on your food spending habits.

The WorkMoney team is here to help readers understand if they are on track with their spending and what they can do to help bring it down without major sacrifices.

The Bottom Line

Averages are a great way to measure what you’re spending compared to others. However, don’t give it too much weight. Everyone has different situations, including dietary intake, income, and more.

More importantly, focus on your own physical and financial well-being. By getting your grocery shopping habits and budget aligned, you can continue to build towards a bright future ahead.

About the Author

Brett Holzhauer

Brett Holzhauer is a Certified Personal Finance Counselor (CPFC) who has reported for outlets like CNBC Select, Forbes Advisor, LendingTree, UpgradedPoints, MoneyGeek and more throughout his career. He is an alum of the Walter Cronkite School of Journalism at Arizona State. When he is not reporting, Brett is likely watching college football or traveling.